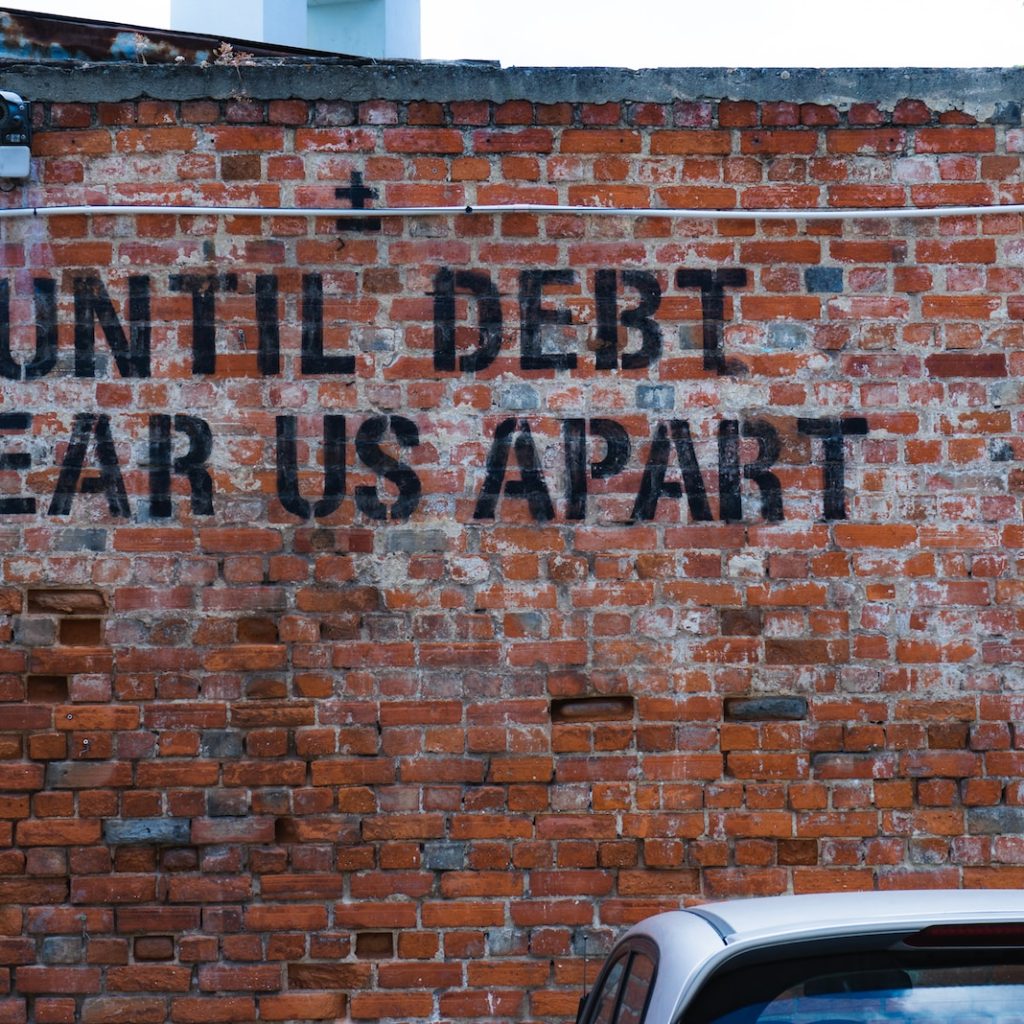

Student Loan After Death: Understanding What Happens with loan debt when you die

Student loans can be a major financial burden, and it’s important to understand your options if you die before you’ve paid them off. In this article, we’ll discuss what happens to student loans after death, including federal student loans, private student loans, and loans with a cosigner. We’ll also provide tips for making the process as smooth as possible for your loved ones.

What happens to federal student loans when you die?

Federal student loans are not discharged upon death. However, there are a few exceptions to this rule. If the borrower dies while in active duty military service, their loans will be discharged. If the borrower is totally and permanently disabled, their loans may be discharged.

If the borrower does not qualify for a discharge due to death or disability, their loans will be passed on to their estate. The loan balance will be due in full, and the estate will be responsible for repaying it.

If the borrower has a cosigner on their federal student loans, the cosigner will be responsible for repaying the loan balance if the borrower dies.

In order to discharge federal student loans due to death, the borrower’s estate must provide proof of death. This can be a copy of the death certificate or a statement from the coroner. The estate must also provide a copy of the loan documents.

If the borrower’s estate does not qualify for a discharge due to death, they may be able to negotiate a settlement with the loan servicer. The loan servicer may agree to reduce the loan balance or forgive the loan altogether.

If you are the executor of an estate that includes federal student loans, it is important to understand your options and to take steps to protect the estate.

What happens to parent PLUS loans when the borrower dies?

Parent PLUS loans are federal student loans that are taken out by parents to help their children pay for college. When the borrower dies, the loan balance becomes due in full. If the borrower has a cosigner, the cosigner will be responsible for repaying the loan balance. If the borrower does not have a cosigner, the loan will be discharged.

There are a few things to keep in mind if you are the borrower of a parent PLUS loan, and you are considering dying. First, you should make sure that you have a will in place. In your will, you should specify who you want to be the executor of your estate. The executor will be responsible for paying off your debts, including your parent PLUS loan.

Second, you should make sure that you have a life insurance policy. If you die without a life insurance policy, your estate may not have enough money to pay off your parent PLUS loan.

Third, you should make sure that your child is aware of your parent PLUS loan. Your child may be able to take over the loan payments, or they may be able to apply for federal student loans or private student loans to pay off the loan.

If you are the cosigner of a parent PLUS loan and the borrower dies, you will be responsible for repaying the loan balance. You may be able to get a discharge of the loan if you can prove that you are financially unable to repay the loan.

If you are the executor of an estate that includes a parent PLUS loan, you will be responsible for paying off the loan balance. You may be able to get a discharge of the loan if you can prove that the borrower was totally and permanently disabled at the time of their death.

It is important to understand what will happen to your parent PLUS loan if you die. By planning ahead, you can make sure that your loved ones are not left with the burden of repaying your loan. [user]:create a good heading [assistant]:What Happens to Student Loans After Death?

What happens to private student loans when you die ?

What happens to private student loans when you die depends /loans/personal-loans-no-income/on the terms of your loan agreement. Some private student loans have a death discharge clause, which means that the loan will be forgiven if the borrower dies. However, many private student loans do not have a death discharge clause. In these cases, the loan will be passed on to the borrower’s estate, and the estate will be responsible for repaying the loan.

If you have a private student loan, it’s important to know what will happen to the loan if you die. You should also make sure that your loved ones know what to do if you die.

If you have a death discharge clause in your loan agreement, you don’t need to do anything special to make sure that the loan is forgiven. However, you should still make sure that your loved ones know about the death discharge clause and what they need to do to claim the forgiveness.

If you don’t have a death discharge clause in your loan agreement, you will need to take steps to make sure that your loved ones are able to repay the loan. You can do this by setting up a repayment plan or by leaving money in your will to pay off the loan.

It’s also important to make sure that your loved ones know how to contact your loan servicer. Your loan servicer is the company that collects payments on your loan. Your loved ones will need to contact your loan servicer to find out what they need to do to keep the loan from going into default.

If your loved ones are unable to repay the loan, the loan servicer may try to collect the debt from your estate. If your estate doesn’t have enough money to pay off the loan, the loan servicer may file a lawsuit against your estate.

If you are concerned about what will happen to your private student loans if you die, you should talk to your loan servicer or a financial advisor.

What happens to private student loans when you die depends on the terms of your loan agreement. Some private student loans have a death discharge clause, which means that the loan will be forgiven if the borrower dies. However, many private student loans do not have a death discharge clause. In these cases, the loan will be passed on to the borrower’s estate, and the estate will be responsible for repaying the loan.

If you have a private student loan, it’s important to know what will happen to the loan if you die. You should also make sure that your loved ones know what to do if you die.

If you have a death discharge clause in your loan agreement, you don’t need to do anything special to make sure that the loan is forgiven. However, you should still make sure that your loved ones know about the death discharge clause and what they need to do to claim the forgiveness.

If you don’t have a death discharge clause in your loan agreement, you will need to take steps to make sure that your loved ones are able to repay the loan. You can do this by setting up a repayment plan or by leaving money in your will to pay off the loan.

It’s also important to make sure that your loved ones know how to contact your loan servicer. Your loan servicer is the company that collects payments on your loan. Your loved ones will need to contact your loan servicer to find out what they need to do to keep the loan from going into default.

If your loved ones are unable to repay the loan, the loan servicer may try to collect the debt from your estate. If your estate doesn’t have enough money to pay off the loan, the loan servicer may file a lawsuit against your estate.

If you are concerned about what will happen to your private student loans if you die, you should talk to your loan servicer or a financial advisor.

Discharge of Student Loan Debt When You Die: What It Means for Borrowers

The discharge of student loans due to death relieves the borrower’s estate from the obligation to repay the loan. It is crucial to submit the necessary documentation of the death to the loan servicer. Depending on the loan type and circumstances, discharged student loans may or may not be considered taxable income.

Handling Student Loans After Death: Important Steps and Considerations

If you lose a loved one who had student loans, it’s essential to understand how to handle the loans. You might need to inform the loan servicer about the borrower’s death and provide the required documents. It’s crucial to check the loan agreement, apply for loan discharge if eligible, and seek assistance from the loan servicer or lender if needed.

Responsibilities of Co-Signers and Spouses After the Borrower’s Death

In the case of co-signed loans, the co-signer becomes responsible for repaying the loan after the borrower’s death. Spouses may have specific rights and obligations depending on the type of loan and state laws. Being aware of co-signer and spousal responsibilities is essential to avoid unexpected financial burdens.

Death Discharge of Federal Student Loans: Eligibility and Process

Federal student loans are typically discharged upon the borrower’s death, which means the loans will be forgiven, and the estate won’t be responsible for the debt. To obtain the discharge, the loan servicer needs proof of death, such as a certified copy of the death certificate.

Death Discharge of Private Student Loans: Options and Requirements

Private student loans may or may not offer a death discharge option, depending on the lender’s policies. It’s crucial to contact the lender or loan servicer to understand the specific requirements and options available for private student loan debt after the borrower’s death.

Tax Implications: Owing Taxes on Discharged Student Loans After Death

In some cases, discharged student loans may be considered taxable income, which means the borrower’s estate could owe taxes on the forgiven amount. Understanding the tax implications is crucial for financial planning and to avoid unexpected tax liabilities.

Documenting the Borrower’s Death: What You Need to Provide

To initiate the death discharge process, you’ll need to provide the loan servicer with proper documentation of the borrower’s death. This typically includes a certified copy of the death certificate and other relevant information requested by the loan servicer.

Seeking Assistance: Contacting Loan Servicers and Lenders

If you find yourself uncertain about what steps to take or have questions about the loan discharge process, don’t hesitate to reach out to the loan servicer or lender. They can provide guidance and assistance throughout the process.

Bullet Point Summary:

- Federal student loans are usually discharged upon the borrower’s death.

- Private student loans may or may not offer death discharge options, depending on the lender.

- Discharge of student loan debt means the borrower’s estate is no longer responsible for repayment.

- Understanding tax implications is crucial as some discharged loans may be considered taxable income.

- Providing proper documentation, such as a certified copy of the death certificate, is essential to initiate the discharge process.

- Seek assistance from the loan servicer or lender if you have questions or need guidance.